How I Saw It

Analysis and Commentary on Environmental Finance (1999–2005)

- 296 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

About This Book

-->

From 1999 to 2005, Richard L Sandor wrote a monthly column for Environmental Finance magazine. The column was called "How I See It", and with this latest publication, Sandor has compiled all of his articles into one comprehensive historical analysis and commentary on the field of Environmental Finance.

How I Saw It offers a historical account of the development of the Chicago Climate Exchange (CCX) from the "father of carbon trading" himself, and also the developments in environmental markets over the years since the Kyoto Protocol in 1997. In his monthly contribution, Sandor makes predictions in his articles, and read for yourself to see if he has been on the right path (or not) all along.

--> Contents:

- Environmental Finance Introductory Remarks

- The Convergence of Environmental and Capital Markets

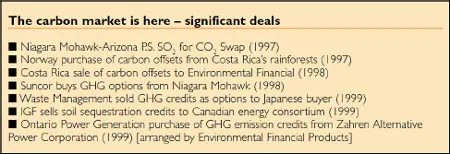

- Voluntary Carbon Deals Break Records

- Seeing the Wood for the Trees

- Trading While the Temperature Rises

- DaimlerChrysler, Ford Change Lanes

- The CDM: Opportunities and Challenges

- SO 2 Market Exceeds Expectations

- US Carbon Trading Project Wins Funding

- The Case for a Simplified CDM

- The US and EU: Closer Than You Think

- CDM — Simplicity is the Key

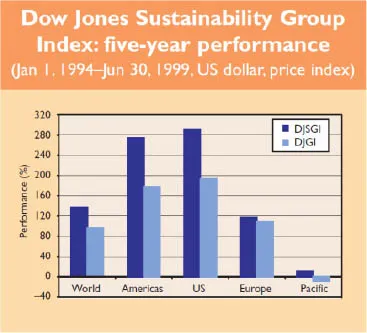

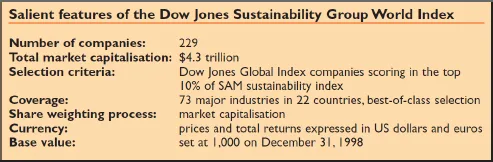

- Dow Jones Sustainability Group Index: One Year On

- A Post-Hague Compromise on Reforestation

- California Utilities: The S&L Crisis Revisited

- The Case for Coal

- SO 2 Auction Shows Power of Markets

- It Ain't Over Till It's Over'

- Corporate Giants to Aid Design of US Carbon Market

- And the Beat Goes On

- The Case for Plurilateral Environmental Markets

- DJSI World: Two Years On

- The Convergence of Environmental and Capital Markets: Another Step

- The DJSI — A Story of Financial Innovation

- Chicago Climate Exchange Progress Report

- Observations on Enron

- A Decade of SO 2 Allowance Auctions

- The Road to Price Discovery

- Here Come the States

- Lies, Damned Lies and Statistics

- DJSI World Index — Three Years On

- NASD Agreement Boosts Chicago Climate Exchange

- How Emissions Can Make Wind Power Pay

- Markets Everywhere

- Chicago Shows the Way

- Institutional Innovation (Part I)

- The Power of an Idea

- Institutional Innovation (Part II)

- Flexibility is the Key

- Water Rights and Wrongs

- The CCX Auction: 20 Questions

- The Benefits of Corporate Sustainability and Responsibility

- Water — New Horizons for Markets

- "The British are Coming!"

- Industrial Policy Skews EU Allocation Plans

- SO 2 Auctions — An Even Dozen

- Here Come the States II

- A Tale of Two Continents

- SO 2 Emissions Allowances — Anatomy of a Mature Market

- Pricing Crude Oil Price Volatility: Can Markets Help?

- An Economist's Progress

- The Benefits of Corporate Sustainability

- CCX — The Year in Review

- Here Come the States III

- Talking About the Weather

- SO 2 Prices — Where Do We Go from Here?

- Weathering the Crude Oil Crisis

- Trading Away Conflict

- Verifying Emissions — Lessons from the CCX

- Beyond Kyoto: Some Thoughts On the Past, Present, and Future

- What a Difference 10 Years Make

-->

--> Readership: Readers interested in climate exchanges and carbon trading; investors, financial analysts, policymakers, undergraduates and postgraduates of finance and economics. -->

Frequently asked questions

Information

Chapter 1

Environmental Finance Introductory Remarks

October 1999

Chapter 2

The Convergence of Environmental and Capital Markets

October 1999

Chapter 3

Voluntary Carbon Deals Break Records

November 1999

Table of contents

- Cover

- Halftitle

- Title

- Copyright

- Dedication

- Praises for How I Saw It

- Foreword

- Acknowledgments

- About the Author

- Contents

- Introduction

- Chapter 1 Environmental Finance Introductory Remarks

- Chapter 2 The Convergence of Environmental and Capital Markets

- Chapter 3 Voluntary Carbon Deals Break Records

- Chapter 4 Seeing the Wood for the Trees

- Chapter 5 Trading While the Temperature Rises

- Chapter 6 DaimlerChrysler, Ford Change Lanes

- Chapter 7 The CDM: Opportunities and Challenges

- Chapter 8 SO2 Market Exceeds Expectations

- Chapter 9 US Carbon Trading Project Wins Funding

- Chapter 10 The Case for a Simplified CDM

- Chapter 11 The US and EU: Closer than You Think

- Chapter 12 CDM — Simplicity is the Key

- Chapter 13 Dow Jones Sustainability Group Index: One Year On

- Chapter 14 A Post-Hague Compromise on Reforestation

- Chapter 15 California Utilities: The S&L Crisis Revisited

- Chapter 16 The Case for Coal

- Chapter 17 SO2 Auction Shows Power of Markets

- Chapter 18 “It Ain’t Over Till It’s Over”

- Chapter 19 Corporate Giants to Aid Design of US Carbon Market

- Chapter 20 And the Beat Goes on

- Chapter 21 The Case for Plurilateral Environmental Markets

- Chapter 22 DJSI World: Two Years on

- Chapter 23 The Convergence of Environmental and Capital Markets: Another Step

- Chapter 24 The DJSI — A Story of Financial Innovation

- Chapter 25 Chicago Climate Exchange Progress Report

- Chapter 26 Observations on Enron

- Chapter 27 A Decade of SO2 Allowance Auctions

- Chapter 28 The Road to Price Discovery

- Chapter 29 Here Come the States

- Chapter 30 Lies, Damned Lies, and Statistics

- Chapter 31 DJSI World Index — Three Years on

- Chapter 32 NASD Agreement Boosts Chicago Climate Exchange

- Chapter 33 How Emissions Can Make Wind Power Pay

- Chapter 34 Markets Everywhere

- Chapter 35 Chicago Shows the Way

- Chapter 36 Institutional Innovation (Part I)

- Chapter 37 The Power of an Idea

- Chapter 38 Institutional Innovation (Part II)

- Chapter 39 Flexibility is the Key

- Chapter 40 Water Rights and Wrongs

- Chapter 41 The CCX Auction: 20 Questions

- Chapter 42 The Benefits of Corporate Sustainability and Responsibility

- Chapter 43 Water — New Horizons for Markets

- Chapter 44 “The British are Coming!”

- Chapter 45 Industrial Policy Skews EU Allocation Plans

- Chapter 46 SO2 Auctions — An Even Dozen

- Chapter 47 Here Come the States II

- Chapter 48 A Tale of Two Continents

- Chapter 49 SO2 Emissions Allowances — Anatomy of a Mature Market

- Chapter 50 Pricing Crude Oil Price Volatility: Can Markets Help?

- Chapter 51 An Economist’s Progress

- Chapter 52 The Benefits of Corporate Sustainability

- Chapter 53 CCX — The Year in Review

- Chapter 54 Here Come the States III

- Chapter 55 Talking about the Weather

- Chapter 56 SO2 Prices — Where Do We Go from Here?

- Chapter 57 Weathering the Crude Oil Crisis

- Chapter 58 Trading Away Conflict

- Chapter 59 Verifying Emissions — Lessons from the CCX

- Chapter 60 Beyond Kyoto: Some Thoughts on the Past, Present, and Future

- Chapter 61 What a Difference 10 Years Make

- Listing of Articles by Subject