![]()

VOLUME 10

Managing Customer Relationships and Building Loyalty

The first step in managing a loyalty-based business system is finding and acquiring the right customers.

Frederick F. Reichheld

Author, strategist, and fellow of Bain & Company

Strategy first, then CRM.

Steven S. Ramsey

Former senior partner with Accenture,

current executive vice president with IRi

THE SEARCH FOR CUSTOMER LOYALTY

Targeting, acquiring, and retaining the “right” customers is at the core of many successful service firms. Segmentation and positioning were discussed in Volume 2, while this volume emphasizes the importance of desirable, loyal customers within the chosen segments, and the painstaking process to build and maintain their loyalty through well-conceived relationship marketing strategies. The objective is to build the relationships and develop loyal customers who will contribute to a growing volume of business with the firm in the future.

Loyalty is an old-fashioned word traditionally used to describe fidelity and enthusiastic devotion to a country, a cause, or an individual. However, in a business context, loyalty describes a customer’s willingness to continue patronizing a firm over a long period of time, preferably on an exclusive basis, and recommending the firm’s products to friends and associates. Customer loyalty extends beyond purchasing behavior, and includes preference, liking, and future intentions (Figure 1).

“Defector” was a nasty word during wartime. It describes disloyal people who sell out, betray their own side, and join the enemy. Even when they defected toward “our” side, rather than away from it, they were still a suspect. In a marketing context, the term defection is used to describe customers who drop off a company’s radar and transfer their purchases to another supplier. Not only does a rising defection rate indicates that something is wrong with quality (or that competitors offer better value), it may also be signaling a fall in profits. Big customers do not necessarily disappear overnight; they often may signal their mounting dissatisfaction by steadily reducing their purchases and shifting part of their business elsewhere.

Why is Customer Loyalty so Important to a Firm’s Profitability?

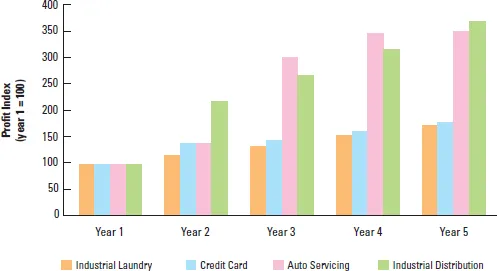

“Few companies think of customers as annuities”, says Frederick Reich-held, author of The Loyalty Effect, and a major researcher in this field,1 and that is what a loyal customer can mean to a firm — a consistent source of revenue over a period of many years. How much is a loyal customer then worth in terms of profits? In a classic study, Reichheld and Sasser analyzed the profit per customer in different service businesses categorized by the number of years that a customer had been with the firm. They found that the longer customers remained with a firm in each of these industries, the more profitable they became. Annual profits increases per customer, indexed over a five-year period for easier comparison, are summarized in Figure 2 for a few sample industries. The industries studied (with average profits from a first-year customer shown in parentheses) were: credit cards ($30), industrial laundry ($144), industrial distribution ($45), and automobile servicing ($25).

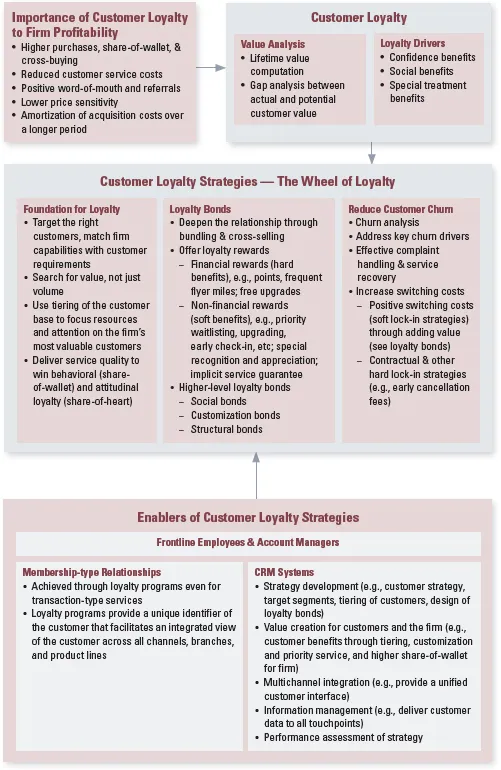

Figure 1: Organizing framework for managing relationships and building loyalty

Figure 2: How much profit a customer generates over time.

Source: Adapted from Frederick J. Reichheld and W. Earl Sasser Jr. (1990), “Zero Defections: Quality Comes to Services,” Harvard Business Review, Vol. 73, Sept–Oct, p. 108.

Underlying this profit growth are a number of factors that work to supplier’s advantage to create incremental profits. In the order of magnitude at the end of seven years, these factors are:2

1.Profit derived from increased purchases (or, in a credit card and banking environment, higher account balances). Over time, business customers often grow larger and thus, need to purchase in greater quantities. Individual customers may also purchase more as their families grow, or as they become more affluent. Both types of customers may be willing to consolidate their purchases with a single supplier who provides high quality service, resulting in what we call a high share-of-wallet.

2.Profit from reduced customer service costs. As customers become more experienced, they make fewer demands on the supplier (for instance, they have less need for information and assistance, and make use of self-service options more). They may also make fewer mistakes when involved in operational processes, thus contributing to greater productivity.

3.Profit from referrals to other customers. Positive word-of-mouth recommendations are like free sales and advertising, saving the firm from having to invest much in these areas.

4.Profit from lower price sensitivity that allow a price premium. New customers often benefit from introductory promotional discounts, whereas long-term customers are more likely to pay regular prices, and when they are highly satisfied they tend to be less price sensitive.3 Moreover, customers who trust a supplier may be more willing to pay higher prices at peak periods or for express work.

5.Acquisition costs can be amortized over a longer period. The upfront costs of attracting new buyers can be amortized over many years. These costs can be substantial and can include sales commissions, advertising and promotions costs, administrative costs of setting up an account, and sending out welcome packages and sign-up gifts.

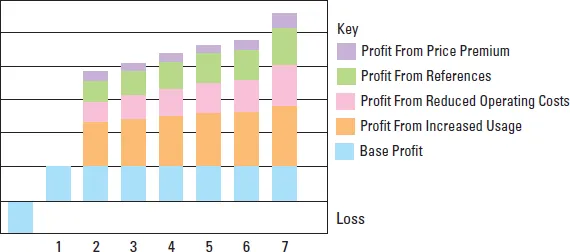

Figure 3 shows the relative contribution of each of these different factors over a seven-year period, based on an analysis of 19 different product categories (both goods and services). Reichheld argues that the economic benefits of customer loyalty noted above often explain why one firm is more profitable than a competitor. As a response, Reichheld and Sasser popularized the term zero defections, which they describe as keeping every customer the company can serve profitably.4

Figure 3: Why customers are more profitable over time.

Source: Adapted from Frederick J. Reichheld and W. Earl Sasser Jr. (1990), “Zero Defections: Quality Comes to Services,” Harvard Business Review, Vol. 73, September–October, p. 108.

Assessing the Value of a Loyal Customer

One of the challenges faced by professionals is to determine the costs and revenues associated with serving customers to different market segments at different points in their customer lifecycles, and to predict future profitability. For insights on how to calculate customer value, see “Worksheet for Calculating Customer Lifetime Value”.5

Recent studies have shown that the profit impact of a customer may vary dramatically depending on the stage of the service product lifecycle. For instance, referrals by satisfied customers and negative word-of-mouth from “defected” customers have a much greater effect on profit in the early stages of a service product’s lifecycle — when the name of the game is acquisition of new customers — than in later stages, where the focus is more on generating cash flow from the existing customer base.6

Finally, it is erroneous to assume that loyal customers are always more profitable than those who make one-time transactions.7 On the cost side, not all types of services incur heavy promotional expenditures to attract a new customer. Sometimes, it is more important to invest in a good retail location that will attract walk-in traffic. Unlike banks, insurance companies, and other “membership” organizations that incur costs for review of applications and account setup, many service firms face no such costs when a new customer seeks to make a purchase for the first time.

On the revenue side, loyal customers may not spend more than one-time buyers, and in some instances, they may even expect price discounts. Finally, profits do not necessarily increase with time for all types of customers.8 In most mass market business-to-customer (B2C) services — such as banking, mobile phone services, or hospitality — customers cannot negotiate prices. However, in many B2B contexts, large customers have a lot of bargaining power and therefore will nearly always try to negotiate lower prices when contracts come up for renewal. This forces suppliers to share the cost savings resulting from doing business with a large, loyal customer. DHL has found that although each of its major accounts generates significant business, they yield below average margins. In contrast, DHL’s smaller, less powerful accounts provide significantly higher profitability.9

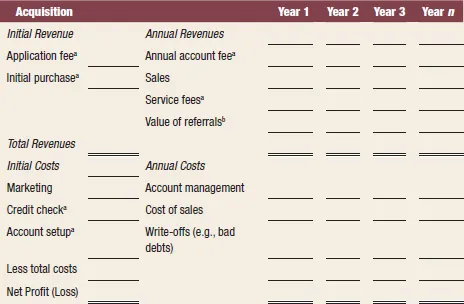

Worksheet for Calculating Customer Lifetime Value

Calculating customer value is an inexact science that is subject to a variety of assumptions. You may want to try varying these assumptions to see how it affects the final figures. Generally speaking, revenues per customer are easier to track on an individualized basis than are the associated costs of serving a customer, unless (1) no individual records are kept and/or (2) the accounts served are very large and all account-related costs are individually documented and assigned.

Acquisition Revenues Less Costs

If individual account records are kept, the initial application fee paid and initial purchase (if relevant) should be found in these records. Costs, by contrast, may have to be based on average data. For instance, the marketing cost of acquiring a new client can be calculated by dividing the total marketing costs (advertising, promotions, selling, etc.) devoted toward acquiring new customers by the total number of new customers acquired during the same period. If each acquisition takes place over an extended period of time, you may want to build in a lagged effect between when marketing expenditures are incurred and when new customers come on board. The cost of credit checks—where relevant—must be divided by the number of new customers, not the total number of applicants, because some applicants will probably fail this hurdle. Account set-up costs will also be an average figure in most organizations.

Annual Revenues and Costs

If annual sales, account fees, and service fees are documented on an individual-account basis, account revenue streams (except referrals) can be easily identified. The first priority is to segment your customer base by the length of its relationship with your firm. Depending on the sophistication and precision of your firm’s records, annual costs in each category may be directly assigned to an individual account holder or averaged for all account holders in that age category.

Value of Referrals

Computing the value of referrals requires a variety of assumptions. To get started, you may need to conduct surveys to determine (1) what percentage of new customers claim that they were influenced by a recommendation from another customer and (2) what other marketing activities also drew the firm to that individual’s attention. From these two items, estimates can be made of what percentage of the credit for all new customers should be assigned to referrals.

Net Present Value

Calculating net present value (NPV) from a future profit stream will require choice of an appropriate annual discount figure. (This could reflect estimates of future inflation rates.) It also requires assessment of how long the average relationship lasts. The NPV of a customer, then, is the sum of the anticipated annual profit on each customer for the projected relationship lifetime, suitably discounted each year into the future.

aIf applicable.

bAnticipated profits from each new customer referred (could be limited to the ...