![]()

Chapter 1

Korean Capital Market

1.1.History of Korean Capital Market

This chapter gives an overview of the history of Korean capital markets based on five sub-periods: the early stage (1945–1967), the development stage for securities infrastructure (1968–1979), the market liberalization and globalization stage (1980–1996), the Asian financial crisis and reform stage (1997–2003), and the globalized capital market stage (2004–). For each period, we explain the status of stock market development; the main issues encountered, such as a market crash; and the enactment or revision of major securitiesrelated legislation.

The Korean capital market was in a poor condition in its early stage because available capital was very limited. However, as the Korean economy rapidly developed, the capital market began to play a role in channeling capital to firms during the development stage. Because the Korean economy is characterized as a small open economy, the capital market also pursued the global trend of deregulation and liberalization of policy during the market liberalizing and globalizing stage. In a liberalized market, each economic unit is required to manage risk by itself. However, the Korean government, firms like chaebols, and financial institutions were left too vulnerable to the Asian currency crisis because of their poor risk management. The Asian currency crisis badly hurt the Korean economy in 1997–1999. Korea accelerated liberalization and globalization of the capital markets during the Asian financial crisis and reform stage. After Korea went through the structural changes of reforms, the risk management capability of each economic unit improved. However, the easy monetary policy during the global financial crisis sharply increased household debt, which has become a major risk for the Korean economy.

1.1.1.Early Stage (1949–1967)

The first Korean securities company, called Daehan securities company and later renamed Kyobo securities company, was founded in 1949. The number of securities companies increased to 33 by 1955 (Lee et al., 2005). The Korea Stock Dealers Association was also founded to help Korean firms raise capital for investment. Their role, however, was limited to arranging over-the-counter (OTC) trading of government bonds until the Korea Stock Exchange (KSE) was incorporated in 1956, with joint contributions from banks, insurance companies, and securities companies. The KSE, now known as the Korea Exchange (KRX), initially listed 12 corporations and 3 government bonds.

The Korean government took over the assets of Japanese corporations in the process of Korea’s liberation from Japan. In the 1950s, most corporations were state-owned companies. They did not want to issue stocks to the secondary market because the demand for stocks was limited as a result of the lack of capital. However, because the Korean government needed immediate and extensive capital to shore up the weak fiscal conditions of the country, it issued bonds in the KSE, and these government bonds were actively traded. According to Yoon (2015), government bonds were issued 17 times between January 1950 and January 1963, amounting to KRW 9.9 billion. In 1957–1960, the trading value of government bonds accounted for 70– 80% in the KSE, compared with only 10–25% accounted for by stock trading.

The market conditions for stock trading were very poor. The number of listed firms and their floating stocks were extremely small, and the investor base was also very limited. Later settlements for securities trading were permitted in the KSE to activate securities trading at that time. Traders could purchase large amounts of securities by depositing a small margin of 10% in a clearinghouse. Such margin trading, however, led the market to be extremely speculative, causing a series of market crashes because of incomplete transaction settlements. Indeed, government bond transactions collapsed on January 16, 1958, because of settlement failure, an event referred to as the January 16 crash of the government’s bond.

According to Yoon (2015), securities companies were divided into a buyer group that wanted the bond price to increase and a seller group that wanted the bond price to fall. These groups aggressively traded to move the government’s bond in their preferred direction. The bond price soared by 2.5 times from June 1957 to December 1957, when the National Assembly announced the reduction of the government’s bond. However, when the National Assembly passed the original plan of issuing the government’s bond at the end of December 1957, the price crashed by 50% for 9 days. The trading volume irrationally increased at that time. The buyer group made ruinous buying orders while the seller group made selling orders without affordable government bonds. As most securities companies failed to pay the required margins, the Korean government nullified all transactions made on January 16, 1958. This incident shows how poorly the securities market in Korea worked at that time. Although the later settlement system caused speculative trading and the market crash, the government could not renounce this system because the market might not have been sustainable with thin trading. Because of the January 16 crash, several securities companies went bankrupt and many investors left, leaving the market in the doldrums for a few years.

In January 1962, the government legislated the Securities and Exchange Act (SEA), which established legal grounds for the organization structure and operation management of the KSE. Under the SEA, the KSE became a corporation whose stocks were listed on the KSE as well. The KSE stocks were attractive to investors because the KSE was expected to develop rapidly, and securities companies wanted to have majority shares to control the KSE. The price of the KSE soared into the sky, increasing by more than 60 times from January to April 1962 and by 136 times from July 1961 to April 1962. Other stocks, such as shares of the Korea Securities Finance Corporation and the Korea Electric Power Corporation (KEPCO) experienced dramatic price increases as well.

The irrational rise of the KSE price at that time could not be explained without the later settlement system. Later settlement made it easy for a number of securities companies to manipulate stock prices even with a small amount of funds because stock buyers could delay payment for stock purchases for 1 month with penalty fees. Under the SEA of 1962, the KSE was required to make proxy payment for stock purchases for stock buyers who delayed payment. Such a proxy payment system made it possible to buy an enormous amount of stock without the funding to afford it.

At that time, people colluded in stock price manipulation. Yoon (2015) wrote, “Since early May 1962, Mr. Yoon Ensang had initiated daily meetings for a stock purchasing group to make buying strategy plans. Tongil and Ilheung securities companies that Mr. Yoon owned were leading buyers for the KSE stocks. The selling group, whose leader was Taeyang securities company, also had meetings to plan their selling strategy. On May 23, twenty-three securities companies met together and decided on the full-scale attack for selling the KSE stocks on May 25. After hearing the attack plan, many buyers switched to sellers.” It was possible to manipulate stock price at that time because of the small number of floating stocks, the narrow investor base, and the later settlement system. Such price manipulation may be the case of market failure. Many investment practitioners at that time believed they could control stock prices when they purchased or sold in cohort. Such a belief still remains in the Korean investment community.

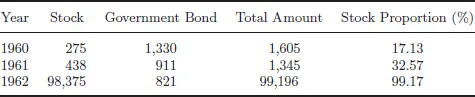

The aggressive buying and selling of the KSE stocks reached the peak of trading volume in May 1962. Table 1.1 shows the extent of the trading volume increase. The proportion of stock trading volume increased from 17.13% in 1960 to 99.17% in 1962. The irrational price level of the KSE stocks was not sustainable, and the stock price of the KSE began to decrease in May. Furthermore, the later settlement system was not sustainable as proxy payments by the KSE excessively accumulated. Indeed, some securities companies failed to pay for stock purchases. This incident, called the Security Crisis of May 1962, resulted in the suspension of the KSE and the bankruptcy of several securities firms. The government redenominated the currency in June 1962, and the KSE reopened in July 1962, but faced serious doldrums. The stock price of the KSE decreased to less than 1% of its peak in February 1963. After experiencing the stock market collapse, many investors lost trust in the securities market and left the market. A deep downturn arrived.

Table 1.1.Securities Trading Amount in Korea from 196 to 1962 (unit: KRW million)

Source: Korea Exchange (1963), Securities Statistics Year Book (cited by Lee et al., 2005).

In 1963, the Korean government revised the SEA to create legal grounds for the sound development of the securities market. The government reorganized the KSE from a corporation into a state-owned entity in response to the Security Crisis of May. In addition, the government mandated that securities firms hold an adequate level of equity to ensure their financial stability and improved the securities transaction systems. Nevertheless, the later settlement system was still allowed in the KSE.

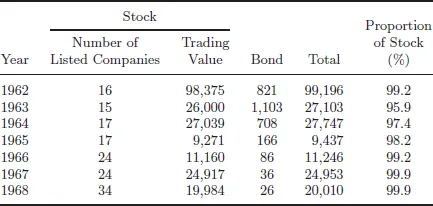

The trading value of securities plummeted after the Security Crisis of May, as Table 1.2 reports. The trading value of stocks decreased from KRW 98.3 billion in 1962 to KRW 26.0 billion in 1963 and then continued to decrease, indicating difficulty in recovering investor confidence in the securities market. The trading value of bonds also decreased substantially, and stock trading accounted for more than 95% of activity in this period. The number of listed firms was still very small during 1962–1968, although it increased to 34 listed firms in 1968.

The equity market did not play a major role in channeling capital to corporations during this period. According to the Capital Cycle of Korea (Bank of Korea, 1976, as cited in Korea Financial Investment Association, 2009), corporations raised capital amounting to KRW 36.2 billion in 1966 and KRW 67.7 billion in 1968 via equity issues. International loans, which were a major source of corporate investment, amounted to KRW 48.8 billion in 1966 and KRW 108.7 billion in 1968. Although equity capital increased between 1966 and 1968, the proportion of equity capital decreased from 23.9% in 1966 to 18.8% in 1968.

Table 1.2.Securities Trading Value (KRW million) from 1962 to 1968

Source: Korea Financial Investment Association (KFIA), (2009), Capital Market in Korea.

1.1.2.Development Stage for Securities Infrastructure (1968–1979)

As demand for domestic capital surged, the Korean government, which desperately needed a large amount of capital for economic development, recognized the stock market as an efficient tool for collecting capital from investors. Beginning in the late 1960s, the government’s policy was oriented to promote Korea’s securities market. In November 1968, the government enacted the Capital Market Promotion Act (CMPA), which was designed to provide tax relief to corporations when they became publicly listed on the KSE. Under the CMPA, the state-owned Korea Investment Corporation (KIC) was established to take responsibility for undertaking initial public offerings (IPOs) because securities firms at that time did not have enough capital to undertake IPOs. Thus, the foundation of CMPA was critically important in facilitating IPOs (Lee et al., 2005).

The government undertook several measures to strengthen the securities market and boost the demand for stock investment. The strongest incentive it offered for going public was providing financial benefits to listed firms by decreasing their corporate tax rate compared to non-listed firms: The corporate tax rate was 20 percentage point lower for a listed firm than for a non-listed firm when taxable income was over KRW 5 million (Lee et al., 2005). In addition, a listed firm could pay taxes or deposits via shares to the central or local government. Several measures were undertaken to increase the demand for stocks: Firms were encouraged to guarantee a certain dividend ratio to all shareholders except the government; shareholders were exempt for the dividend tax; the entry barrier for securities firms was lowered by substituting the registering system for the approval system; and the Securities Investment Trust Business Act (SITBA) was introduced in August 1969. Under SITBA, investment trust businesses were permitted to increase demand for stocks through the indirect investment of retail investors. In December 1971, the government finally abolished the later settlement system to discourage overspeculative investment and to activate cash transactions.

Although the CMPA was designed to encourage corporations to go public and become listed on the KSE, only one corporation did so (Lee et al., 2005). Corporations could receive corporate tax benefits without actually being listed on the KSE because the requirements for going public were too loose. In addition, firms wanted to avoid going public because they worried about losing their corporate control or revealing corporate secrets.

As of June 1971, interest on a bank loan was 22% per year (Korea Bank, 1974), but corporations had difficulty in obtaining bank loans because available loans were so limited for them. Corporations with growth opportunities therefore had to rely on private loans as a source of capital, but the interest rates on private loans was two or three times higher than that on bank loans. Economic real growth stayed above 10% between 1968 and 1971; however, as it decreased to 7.2% in 1972, many corporations could not pay the high interest of private loans and became financially distressed.

In August 1972, the government announced the Emergency Order for Economic Development and Stability, the main measure of which wa...