![]()

![]()

Chapter 1

Take Back Control Of Your Wealth Creation

It has always been my belief in life that you should never ever tell anyone where to buy, what to buy and when to buy it. It is ethically wrong. No one has a magic crystal ball. Even people who have invested for many years make bad decisions. It’s up to individuals and what risks they want to take. Are you committed to reaching your goals, therefore really committing to what you need to do every day to achieve them?

In my earlier days of investing I was told by many bank managers and accountants, “We do not know how you do it but you guys have a cloth and sometimes its ringing wet (that’s when we have cash). When we need to pull our spending back it’s like there are two people at each end of the rag and it’s wound up so that there is nothing left. They say that’s where the saying comes from, us! We can live off the smell of an oily rag. We could just pull our purse strings in when we were looking at a bigger and better investment.

No one likes to do without but, to be honest, measuring wealth isn’t about how much money you have to spend today. It is measured by what money you are spending, so if you are collecting your pay and spending everything. Say hypothetically you lost your job tomorrow, your wealth would stop in its tracks. You are wealthy if you lose your job but you still have income coming in and able to pay rent, mortgage, food, clothing and transport. For me, this was my wealth strategy replacing my income as fast as possible in the safest way possible. That is what I thought true wealth was. You are reliant on nobody if you lose your job you still have an income.

Whether your rent is $300 a week or $1700 a week, whether your clothes, food and transport are $250 a week or $3000 a week, you have to think, ‘Can I cover those expenses if my income (job) stopped tomorrow?’

If not, that should be your goal for a passive income; either the rent of $300 + expenses of $250 = $550 a week or the rent of $1700 + expenses of $3000 a week = $4700 a week.

If you can already do that, you are amazing. I congratulate you and hope you can still get some insights from this book for your investments in your (SMSF) Self Managed Super Fund.

If you could not cover your bills, then you really need to take a leap of faith. Start looking at ways to set yourself up so that you could survive this situation of loss of job (income). Some of your stories will be scary when you see what you actually spend on a daily, weekly, monthly and yearly budget. Compare how it would hold up against an age pension; it will make you sit up and take notice. Make some massive changes to create a better retirement future, or any future for that matter. Your story may be scary but hopefully through these pages you will see the answers and the time you need to spend on re-educating your mindset to plan for massive wealth creation in an SMSF.

We need to go back to where I started living in survival mode. When I was 19, I moved to Sydney and wanted to pay $50 a week in rent. Everyone said I would not get rent that cheap, especially in the Eastern suburbs (Rose Bay). I did, I got an attic for $50 a week. My brother Kel came around, as he was heading home for a holiday and he was shocked. He said, “You can’t live here!” It was 3 x 4 metres in size, an average laundry today, and the previous tenant hadn’t moved out, Mr. Rat. My brother said, “You have to get the landlord to fix it up.” I said, “No! They will charge me more rent.” I bought cleaning products and some gloves and I painted that unit, made some curtains and a nice bed cover and you wouldn’t have known it was the same place. I came up the stairs and then closed the trapdoor, as that was part of my floor, and I felt very safe. I didn’t have to use my car as work was within walking distance. I am not saying you have to be that extreme but YOU NEED YOUR MONEY TO STICK TO YOU. If you will promise to do one thing for me, watch how your money comes in one hand and quickly goes out the other. It does not stick. For a lot of people it’s a fact. Buying a new wardrobe for that special function may not be necessary, have a look inside your wardrobe, pull out all the clothes that are stuffed in a drawer or the outfits you have on the one coat hanger that you couldn’t see because of all the outfits on top. Look in the multiple boxes of shoes you have accumulated and forgot about. New earrings or a new tie for $10 or $20 may be all that’s required, rather than a new outfit. It looks different and you haven’t worn it with this bunch of friends. A new outfit, shoes, dress or a suit and new tie wouldn’t give much change from $500. That’s 5 - 10 weeks of Self Managed Super contributions.

Think 8 cups of coffee a week = $36 and dinner out isn’t short of $100. Instead of looking in the grocery store at eye level look above and below. You will save at least 20% an item, times that by the average number of food items you buy; that’s a big saving each week. Buy with your credit card. Leave more money in your offset account or invested in shares and get 55 days interest free on your credit card then shop at Christmas for free.

Make your friend a lovely birthday cake its personal and they will love it. Everyone buys what they want, so save yourself money and them from trying to stuff another item into their wardrobe.

For transport, get a car that is 6 - 7 litres per 100 km not 14 litres per 100km. By changing my car to a Mitsubishi diesel, I worked out that for urban driving, meaning just driving around town, I saved nearly half of my petrol bill.

It was amazing. I saved $50.00 a week. I also still use the art of negotiation; it’s been around for centuries. I locally priced the Mitsubishi I wanted and then saw it in a newspaper advertisement 6 hours down the road at Alto Mitsubishi Pennant Hills, Sydney, for $6000 cheaper. So I rang the dealer and that was the price plus they threw in extras so I calculated a 6 hours drive divided by $6000 gave me an income of $1000 p/h so I got there took the deal and contributed $6000 to my SMSF. My car was ready and they offered us coffee and made us feel very welcome. I saved on my car and on tax by contributing to my SMSF. I also had a loan for my old car at 9%. They say money doesn’t come easily but the day that I’d calculated petrol costs and what car to buy, Rod rang one of my favourite bank managers and he said, “We are doing a deal, I can give you a car loan for $30K @ 6%.” That made my mind up.

Never underestimate the century old negotiation skills on anything you buy, even the interest on your mortgage. Money is very cheap and we paid interest rates on our investments at 18% 12% 9% so now is a whole different ball game. Some of my friends do not shop with me but, within reason,that is a gift I have. I am not scared of rejection when it comes to saving money. If you are buying a big ticket item, you especially need to get at least three quotes or go to three different shops. If you are not amazed, well you need to update your skills. If you don’t ask you will never know.

Take a picnic instead of a take-away, it’s much healthier. Change just a few of these habits and pull the purse strings tighter and you’ll be amazed at how much money accumulates. It may allow you to put at least $50 - $100 a week into your SMSF which would add up to $2600 - $5200 a year. When we talk about tax, you would be saving even more because if you received that $5200 in income and you were in a higher tax bracket, you could be losing over 30% - 40% of that money. If you contributed this $5200 and salary sacrificed you would only lose 15% and you would still have $4420, so it is really worth cutting your costs to teach your money to stick to YOU not the tax department!!

Unless you have a way of getting money to fall from thin air you have to build up a deposit or equity in some way so that you can start buying investments that provide passive income, I am going to teach you a strategy that will make it seem like money is falling out of air. First, you must have a start-up amount. This is the only way you can do it. Make your money stick TO YOU.

As you can see, I am very passionate about SMSFs. I think it is Super Duper Leverage that the ATO (Australian tax office) gifts you back a lot of the tax that you pay outside your SMSF. Realise that the ATO is actually gifting you back money for educating yourself to invest in your financial wealth creation plan. Did you know that? They are rewarding you for investing in anything that is inside an SMSF that earns an income and creates wealth for you. How amazing is that???

If you are diligent and careful, this concept could really feel like you have this amazing lever that can get under your SMSF and leverage it to the sky. I will also show you how we can get people willingly to make super contributions to your SMSF through renting property; putting a layby on your shares. Writing covered calls on your blue chip shares and only paying 15% tax, WOW! How amazing is that?

Be honest with yourself, and you have to be fully committed to getting results. Everyone’s story will be different in income, our age and in risk to reward ratio. There should be no risk on what your SMSF can do as long as you listen to the tax experts, ATO and your accountant (who is the only other tax expert).

I have seen friends come from abusive situations, both men and women. They have found an inner strength to beat all odds and continue forward. These are the friends I am inspired by it is their inner strength. In life there are no excuses and there should be no blame game, only you for not taking action to help yourself. You need to find your inner strength and turn your life around if that is what you need to do.

Whatever you decide to invest in, make sure that you have been educated in that investment strategy and it is insured, then double check that again with your safety net. You cannot take risks. Your money in your SMSF must be safe and running a marathon, making money all day and all night to fund the retirement you so truly deserve.

Independent wealth creation is important as it allows you to do the things you enjoy life is easier health issues are attended to with your choice of doctor and the specialists you trust and smaller issues don’t turn into lifelong health issues. Having money can pay for fitness to keep your bones strong and prevent injury.

Your outlook on life truly changes when you are self-sufficient in managing your wealth for the future. The older you become the more you worry, this can be significantly reduced with financial independence. You need to prioritise today and take action to become financially independent as soon as you can. You will be healthier, happier and live with gratitude and grace. Let’s get started fast tracking and transforming your superannuation into your very own Self Managed Super Fund. I believe it is a SELF MANAGED SUPER DUPER FUND.

I’ll leave you with that thought. Now let’s get your story started.

I want to thank you for being honest with yourself and learning how to invest fully in your SMSF so that you can be self-sufficient when you retire, enabling you to help your family and not be a burden to them financially. I want you to leave a continuous legacy; wouldn’t that be amazing?

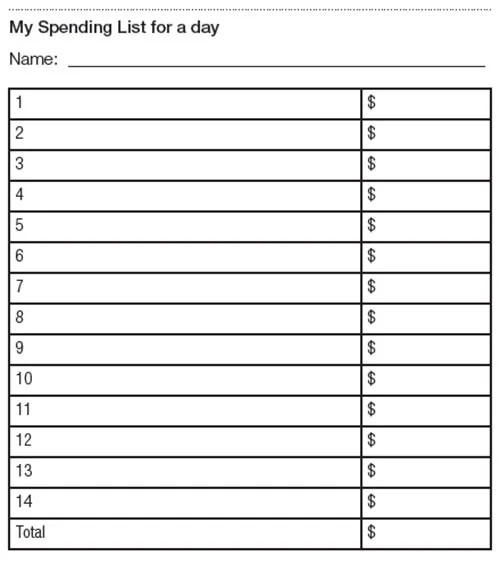

It would be great if, for just 1 day or 1 week, you could write down in a little notebook or on the list below, exactly where your money went for that day. It can be bills or pleasure or anything but watch how the money slips through your fingers, like a vacuum. How much money doesn’t stick to you? Ask yourself why you are allowing this to happen. How can you make it stick, so that you can invest in some passive income and have a guilt free spending habit knowing that your income is there for life, not just your working life?

Okay, let’s hope you can do that for a day, a week or a month. That would be great. Let’s see how much you can change and how much money you can make stick to you. Don’t rely on the government, who knows what will become of the pension. You are the only one who is truly interested in you and your family’s wellbeing You are the only one who will stay truly dedicated and take massive action to change your situation. If you sit and wait for someone else to do this for you, you will become dependent on everyone else and you will not have financial control.

Diagram 8: Here is your list for 1 day; write down your spending habits. Don’t miss anything and look back to see where it went. You will be amazed. It’s a great exercise. Next, do it for a week and then a month. That’s when you really see your spending habits.

Put this list on the fridge and Look at this...