![]()

Chapter 1

RETIREMENT ISSUES ACROSS THE GLOBE

In the most advanced countries, the number of individuals aged 60 and older is increasing 60% faster than the population overall. This trend has a tremendous impact on the ratio of retirees to workers, which is estimated to reach one retiree per every four workers by 2050. As a result, the shrinking of the labor pool in proportion to the number of retirees will have a bigger impact on retirement than almost any other factor.

In recent years, almost every state has undergone a significant change in its pension system; increasing life expectancy and widely falling birth rates have increased − or are about to increase − the share of the population dependent on public pension schemes. At the same time, the growing importance given to austerity and balancing budgets has aggravated the situation and many states ran the risk of straining their pension systems.

Pension reforms undertaken to date are largely driven by the financial sustainability of the pension schemes and most of them will reduce the generosity of pension benefits to future generations. Some countries raised the contribution rate. Primarily, though, reforms concentrated on pension entitlement in order to compensate for longer life expectancy (and therefore for the longer expected pension entitlement period). As a result, many countries implemented parametric reforms to the way retirement income is calculated and to eligibility requirements.

Policy makers have also recently recognized the need to make saving accessible and incentives less complex. The states have sought for people to take greater ‘self-responsibility’ for their retirement income, but many people wish for some certainty with respect to the pensions they can expect. These goals might well be in conflict.

The issue of under-saving for retirement has been acknowledged and potential solutions have been debated for some time. What is relatively new is increasing awareness of the phenomenon of the ‘ageing population’ and the increasing urgency of the need to ensure sustainable solutions to the problem of how best to provide for the projected increase in the numbers of people in retirement. People’s attitudes and behavior may be such that they save less for their retirement than is desirable or have what might be misplaced faith in alternative means of funding their retirement, such as housing wealth.

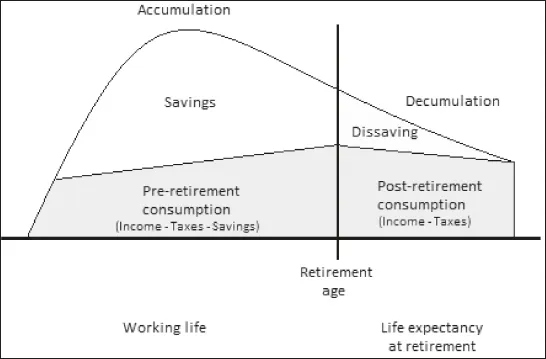

Why save for retirement at all? The short answer is that because over a person’s lifetime, income and wealth change as people move through their lifecycle. Saving allows one to accumulate wealth to draw on at times when income is lower, such as in retirement. Wealth is accumulated through the individual’s working-life in order to fund consumption after retiring. Thus, rational individuals borrow when young, save in middle age, to build wealth, and spend these savings in old age.

Saving for retirement

Retirement was once a simple proposition: Individuals worked a lifetime and saved, employers provided a pension, and payroll taxes funded government benefits. The end result was a predictable income stream, generated from three stable sources that could provide a financially secure retirement. But demographics and economics have rendered old models unsustainable. In response to surging populations and expanding lifespans, employers continue to shift the responsibility of retirement funding to the individual, and policy makers are challenged to respond.

It’s clear that in the coming decades, individuals will need to assume a greater share of retirement funding, but even as they do it’s important to remember that ensuring retirement security is not solely their responsibility. Policy makers and employers still need to ensure workers have the tools, resources and education they need to be successful. People are assumed to retire above today’s average retirement age and they are assumed to derive the maximum possible income from the assets they hold at retirement. The only way out of this box is for people to save more and/or work longer.

We should be interested in the subject of financing retirement for two reasons. First, we will almost certainly receive some retirement income from a social government policy designed to provide a minimum standard level of living. Second, we will probably need to save and invest a considerable part of our earnings to provide the overall standard of retirement living we would like.

The saving cycle

Without enough savings or ways to earn much money later in life, many of the oldest people could be left with modest Social Security checks as the only reliable, inflation-adjusted source of income. The responsibility for financial security in retirement is falling even more heavily on individuals than ever before and this trend is likely to continue as government resources in countries around the world become scarcer. It is becoming increasingly apparent that to ensure financial security in retirement, individuals need to take personal ownership of their destiny and view planning and saving for retirement as a serious, conscious and strategic pursuit.

In the very earliest years of our career, we may spend most of our earnings, but thereafter we will spend less than we earn in order to support our desired standard of living in later years. After we leave our job or career, our wage or salary earnings will decrease or stop entirely. But we will want to have some sort of income in our later years. To provide this, we will need to spend less than our before-tax earnings during our working years. The social program in our country will likely do some of this for us by deducting required contributions from our wages or salary, likely obtaining additional amounts from our employer, then making payments to us after we retire. Our employer may deduct additional amounts and provide some post-retirement benefits as well. But in all likelihood we will want to further smooth the pattern of our spending over time by saving and investing some of our remaining discretionary income. To do this, we will need to move money from our working years to our retirement years. Increasingly, the burden will be on us to make intelligent saving and investment decisions.

Ch. 1 – Fig. 1: Saving cycle

A simple strategy for individuals looking to ensure a secure retirement would be to save more and start saving sooner. In reality, it’s not that simple. Life is complicated and brings with it many competing priorities. Saving for a child’s education, caring for elderly parents, and other more immediate needs can often take precedence over the long-term objective of securing one’s retirement funding.

Perhaps the best step forward for individuals is to set realistic goals. Beyond a stronger commitment to financial planning, we believe individuals who are now being asked to shoulder a larger share of retirement funding should look closely at the options available to them. If they have a pension, they should calculate their expected annual payout, along with potential government benefits they may receive, to determine just how much they will be required to contribute to their retirement income from their personal savings. Recognizing the pension gap early can be a powerful motivation to increase personal investments. As investors around the world look to ease the burden of funding retirement, financial advisors are stepping forward to help clients set clearer goals and establish more specific plans for both accumulating retirement assets and turning savings into a reliable income source in retirement. To clearly define retirement goals and expectations on retirement income is among the key trends that are shaping today’s advisory practices. While they cannot resolve the deep structural challenges some governments face, financial advisors are in a position to drive demand for investing strategies that will empower individuals with greater control of their own financial security and deliver portfolios that can withstand market fluctuations over time.

If longer life is a financial threat, it is one that we can spot creeping toward us from decades away. The chances of extreme longevity are far smaller for current retirees and older workers than for their grandchildren. For younger workers, there’s time to save more, to reimagine lives that include later life careers and to create better financial products to help ensure that income lasts a lifetime. And there’s time for employers and governments to work together on creative solutions.

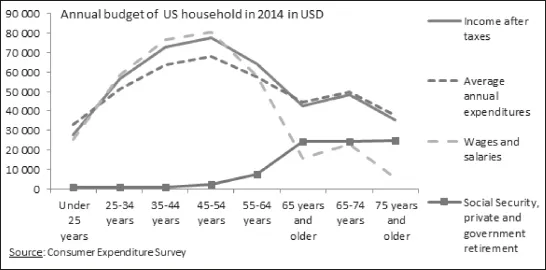

Fig. 2 is a likely pattern for the lifetime cycle of our income and spending. For each of several age categories, it plots the average annual before-tax wage or salary income for a consumer unit (household) in the United States in 2014, along with the average annual expenditure. While our experience will differ, it is likely to follow a similar cycle as we go through life.

Ch. 1 – Fig. 2: U.S. consumer units, average income and expenditures

In the new world of retirement financing, we will very likely have to decide how much to save, how to invest the proceeds and what to do with the resulting money when we retire. Capital markets are highly competitive. It is very unlikely that we will find a strategy that provides long-term returns absolutely guaranteed to be greater than those available from low-risk government securities. Most other securities are risky in both the short-term and in the long-term. We may well want to invest at least part of your funds in some of them. But understand that, at best, our eventual retirement standard of living will be uncertain and could fall anywhere in a potentially wide range of possible outcomes.

The implication is that we should diversify widely across many risky investments so that the main risk we bear is that of a major fall in markets worldwide, due to fears of widespread recessions, financial crises and other catastrophes. Consider investing our retirement savings either directly or via an annuity in a combination of low-risk inflation-protected securities and one or more funds representing a global portfolio of bonds and stocks. The more willing we are to take on added risk in the pursuit of added long-run return, the greater the proportion we should invest in the risky portfolio. However, the primary personal asset of most citizens is their own homes. The other assets of most families are modest, and what one household saves scarcely offsets what another house-hold borrows. As a result, the aggregate savings rate, except for employer-sponsored pensions, is sometimes not enough.

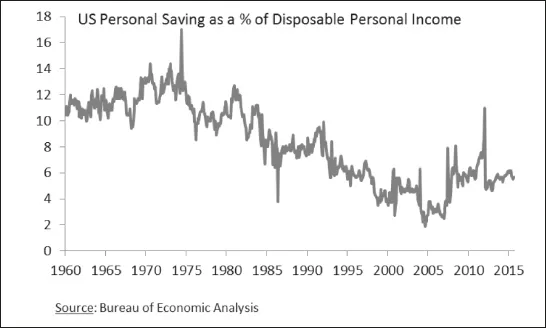

Many reasons have been advanced to explain the anemic savings rate in the United States, especially as it has fallen over the past 10 years. Until recently, one reason was the decline in the percentage of people in the population between the ages of 45 and 64, the age group considered the most aggressive savers. It was thought that once baby boomers entered this age group, the personal savings rate would climb. However, recent statistics indicate that, although many baby boomers have already entered the traditionally peak savings years, personal savings rates continue to fall.

Ch. 1 – Fig. 3: U.S. saving rate

Government, Employers and Individuals, the three legs of the global retirement savings stool, each have a role to play in improving the state of savings around the world. Governments need to work together to institute meaningful, difference-making reforms. Employers need to be more flexible and open to considering programs that can broaden coverage. And individuals need to realize that they can no longer depend on the other two legs of the stool, and instead should focus on the factor...