AI & Quantum Computing for Finance & Insurance

Fortunes and Challenges for China and America

- 692 pages

- English

- ePUB (mobile friendly)

- Available on iOS & Android

AI & Quantum Computing for Finance & Insurance

Fortunes and Challenges for China and America

About This Book

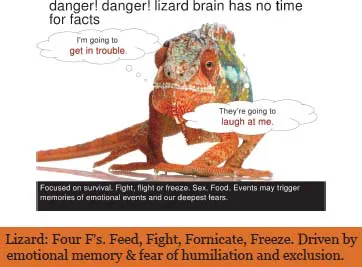

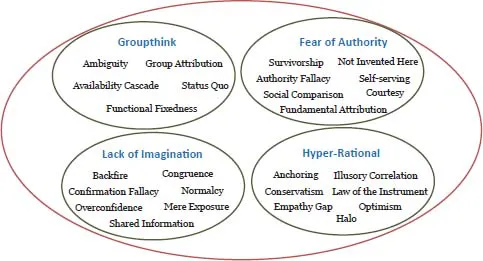

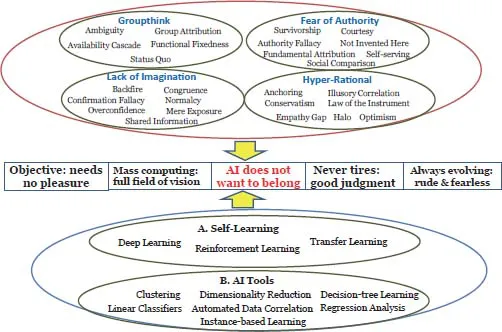

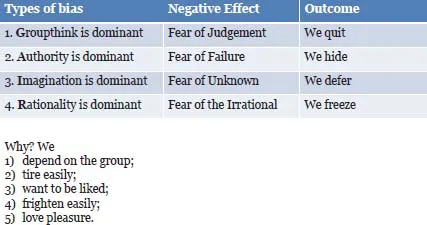

This book offers a framework and analysis for the current technological landscape between the United States and China across the financial and insurance sectors as well as emerging technologies such as AI, Blockchain, Cloud and Data Analytics and Quantum Computing (ABCDQ). Based on original lecture slides used by the authors, the book presents contemporary and critical views of emergent technologies for a wide spectrum of readers from CEOs to university lecturers to students. The narrative aims to help readers upgrade their technology literacy and to overcome the fear of AI posed by our lizard brain.

Contents:

- Acknowledgments

- Introduction

- How to Escape the Corporate Lizard Brain: The True Role of AI:

- Purpose of AI: Naming and Shaming the Corporate Lizard Brain — One Meeting at a Time

- Case Study: US vs PRC in the Banking Lizard Brain Shift to AI FinTech Machines

- Banking and Insurance Transformation in the US, China, and Southeast Asia:

- How the Mighty are Learning to Change: Who is Evolving and Who is Dying

- New Entrants and Traditional Banks are (Finally) Trading in Lizard Brains for an Upgrade

- Banking on the Transformation of Blockchain

- Blockchain Disrupts Http and SWIFT

- Global Leadership in the Transformation with AI and Banking/Insurance:

- Alibaba vs Tencent: The Great Race

- Ping An: Blazing New Trails and Connecting the Dots

- Huawei and the Global Landscape in 5G and Cloud

- India: Walmart, Amazon, Alibaba, and Tencent in India: WHAT the Hell is Going On?

- How New Technologies Will Revolutionize the Infinity of Digital Signals Out There:

- Quantum Computing: It is Around the Corner — Get Ready!

- Cloud Wars: Alicloud vs AWS and Azure (and What Huawei Wants to Do About It)

- Insurtech: Digitizing Head, Health, Hands and Heart

- Singapore Back in the Game When the Titans Clash: Will It be SMART Enough?:

- Singapore: An Outsider and Smart Nation Back in the Game!

- Appendices:

- Alibaba

- Ping An

- Tencent

- Baidu

- Zhong An

- Softbank

- Amazon AI

- Apple

- Microsoft AI

Readership: Undergraduate and graduate students, professionals working in financial institutions and those interested in financial technology worldwide.Financial;Lizard Brain;AI;USA;China;Banking;Insurance;Cloud;Quantum Computing;Insurtech;FinTech;Blockchain;Data Analytic;Singapore;Technology;Alibaba;Ping An;Tencent;Baidu;Zhong An;Softbank;Amazon;Google;Apple;Facebook;Microsoft0 Key Features:

- No competing title that provides an in-depth and critical exposition of the emergence technology environment and its challenges and opportunities

- Provides an exposition and framework for anyone who is interested in the technology environment

- Presents concepts of deep emerging technologies and new disruptive business models, accessible to the general public

Frequently asked questions

Chapter 1

Purpose of AI: Naming and Shaming the Corporate Lizard Brain — One Meeting at a Time

1.1How Us Frail Humans Can Make Peace with AI

Table of contents

- Cover

- Halftitle

- Title

- Copyright

- Contents

- Acknowledgments

- Introduction

- Part 1: How to Escape the Corporate Lizard Brain: The True Role of AI

- Part 2: Banking and Insurance Transformation in the US, China, and Southeast Asia

- Part 3: Global Leadership in the Transformation with AI and Banking/Insurance

- Part 4: How New Technologies Will Revolutionize the Infinity of Digital Signals Out There

- Part 5: Singapore Back in the Game When the Titans Clash: Will it be SMART Enough?

- Appendix: