Achieving Investment Excellence

A Practical Guide for Trustees of Pension Funds, Endowments and Foundations

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Achieving Investment Excellence

A Practical Guide for Trustees of Pension Funds, Endowments and Foundations

About This Book

Crucial methods, tactics and tools for successful pension fund management

Achieving Investment Excellence offers trustees and asset managers a comprehensive handbook for improving the quality of their investments. With a stated goal of substantially and sustainably improving annual returns, this book clarifies and demystifies important concepts surrounding trustee duties and responsibilities, investment strategies, analysis, evaluation and much more.

Low interest rates are making the high cost of future pension payouts fraught with tension, even as the time and knowledge required to manage these funds appropriately increases — it is no wonder that pensions are increasingly seen as a financial liability. Now more than ever, it is critical that trustees understand exactly what contributes to investment success — and what detracts from it. This book details the roles, the tools and the strategies that make pension funds pay off.

- Understand the role of pension funds and the fiduciary duty of trustees

- Learn the tools and kills you need to build profound and lasting investment excellence

- Analyse, diagnose and improve investment quality of funds using concrete tools and instruments

- Study illustrative examples that demonstrate critical implementation and execution advice

Packed with expert insight, crucial tools and real-life examples, this book is an important resource for those tasked with governing these. Achieving Investment Excellence provides the expert insight, clear guidance and key wisdom you need to manage these funds successfully.

Frequently asked questions

Information

PART One

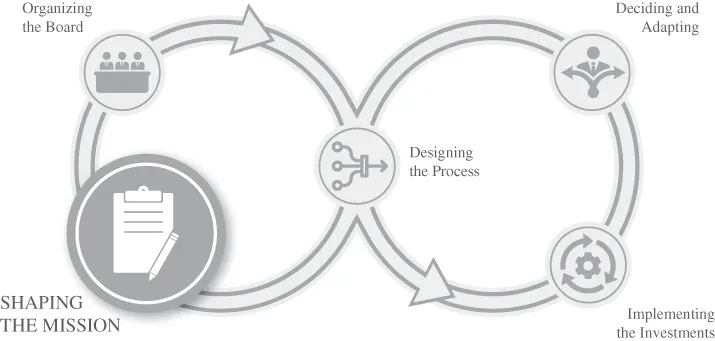

Pension Funds: Understanding the Role, Shaping the Mission

Part I Topics Include:

- The role of a pension fund, and the roles of a board and its trustees;

- The meaning of fiduciary duty;

- How to formulate the mission, vision, and strategy of a pension fund;

- The importance of explicitly stating the strategic foundation of a fund in order to avoid confusion later on in the process.

CONTRIBUTION OF THIS PART TO INVESTMENT EXCELLENCE

CHAPTER 1

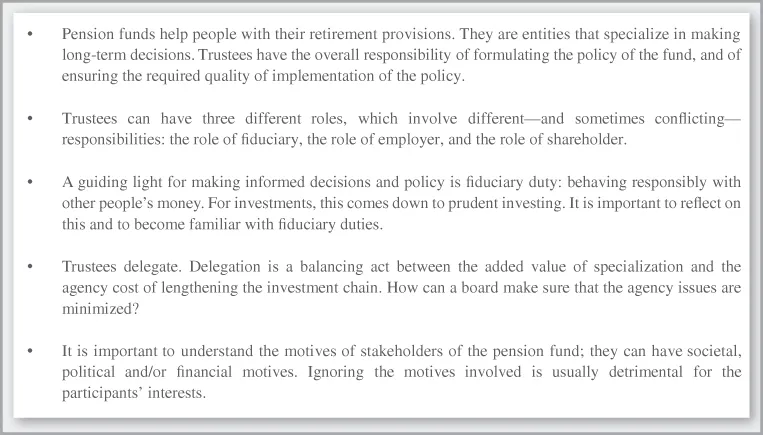

The Role of Pension Funds, and the Role of Boards

Key Take Aways

THE ROLE OF PENSION FUNDS

- A pension agreement that describes the pension benefit structure and guides day-to-day operations;

- A trust fund, foundation or other form of organization, independent from the sponsor, to hold the plan's assets and the administration of pension benefits. The trust is legally and financially independent from the companies;

- A record-keeping system to track the flow of money going to and from the retirement plan;

- Documents to provide plan information both to the employees participating in the plan, and to the government;

- At times, a number of officials with discretion over the plan; these are the plan's fiduciaries.

Table of contents

- Cover

- Table of Contents

- About the Authors

- Acknowledgments

- Foreword

- Introduction

- PART One: Pension Funds: Understanding the Role, Shaping the Mission

- PART Two: Designing the Process

- PART Three: Implementing the Investments

- PART Four: Organizing the Board

- PART Five: Learning, Adapting and Improving

- Self-Reflection Questions

- Appendix A

- Appendix B

- References

- Index

- End User License Agreement