Behavioral finance is an interdisciplinary research area that combines insights from psychology with finance to better understand investors' behavior and asset prices. It has managed to bridge the gap between theory and practice. Moreover, the psychological research that behavioral finance is based on recently got a foundation in biological differences found in the brain.

Traditional finance has focused on the ideal scenario of thoroughly rational investors in efficient markets. According to this standard paradigm in finance, individuals rationally search for information and know all available actions that serve their preferences. The latter are stable over time and robust to the occurrence of unanticipated events. As a result, rational investors searching for superior returns detect and eliminate any predictability in the asset prices—the market is efficient. According to traditional finance, the market remains efficient even if some investors behave irrationally. Indeed, rational investors will detect any mispricing generated by irrational investors and exploit it with the use of arbitrage strategies, which are assumed to be unlimited.1 Consequently, any mispricing will very quickly be corrected, irrational investors will be driven out of the market, and the market will again quickly become efficient. A statistical consequence of prices being unpredictable is that returns are (log)‐normally distributed—which is the content of the central limit theorem—a cornerstone of statistics. Consequently, optimal decisions can be taken based on the two parameters of a normal distribution: the mean and the variance. Thus, the mean‐variance optimization and the efficient markets hypothesis are logical consequences of the rationality assumption.

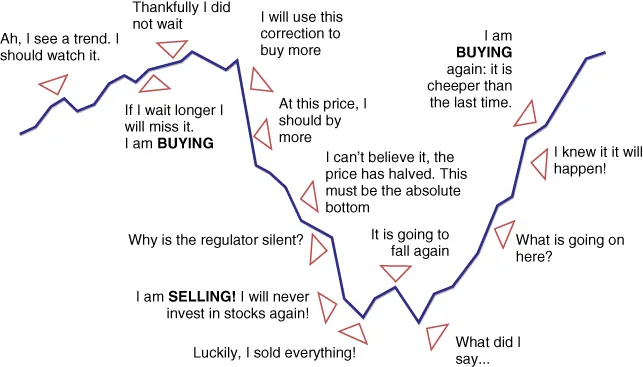

In practice, however, we observe that even professional investors behave irrationally. Moreover, there is empirical evidence that the use of arbitrage strategies to exploit observed mispricing is limited (e.g., implementing an arbitrage strategy could be expensive and typically not at zero risk). The consequence of irrational investors and limited arbitrage is inefficient markets. As we will discuss in detail, investors are not always able to make rational decisions so that market prices show anomalies. For example, investors tend to adopt the behavior of other investors, and this herding behavior causes short‐term predictability that leads ultimately to market crashes. Consequently, asset returns are no longer normally distributed. For example, they have fat tails (i.e., too many very bad returns)—which Taleb (2007) called black swans. Moreover, in inefficient markets, the mean‐variance optimization is no longer rational. Thus, ignoring the insights from behavioral finance can be costly for investors adhering to traditional finance.

Behavioral finance emerged when Nobel laureate Daniel Kahneman and his colleague Amos Tversky conducted psychological research to question the assumptions of rationality—a cornerstone of the classical decision theory. Kahneman & Tversky (1979) developed a new theory, which they called prospect theory. Prospect theory has two phases: an editing phase and an evaluation phase. In the first phase, Kahneman and Tversky show how choice alternatives are mentally coded and transformed to be evaluated in the second phase. The editing phase has developed into a rich knowledge of behavioral biases—the topic of the next section. In the evaluation phase, Kahneman and Tversky develop a new decision model, which is the main content of our section on decision theory. The knowledge of behavioral biases is very valuable for a better understanding of clients in wealth management. Prospect theory also offers a risk measure that is consistent with the client's experience. With this measure one can construct asset allocations that better suit the clients than the asset allocations based on the volatility used in traditional finance. Prospect theory states that investors dislike losses more than volatility. In fact, investors react more to losses than they react to gains. Unlike volatility, the psychological risk measure is not the same for all investors, but is a characteristic of the individual. For this reason and others, the advantages of having a quality risk profiling procedure are numerous.

In this book, we apply these insights from behavioral finance to truly identify the client's situation from a holistic standpoint. With discoveries in the way people deal with information and respond to it in investment risk taking, it is reasonable to say that behavioral finance gives more attention to the investor's behavior. A more realistic investor, as described in behavioral finance, has a different perception and a different understanding of risk than the theoretical investor in the traditional decision theory. Consequently, this investor will need to invest differently than the theoretical investor in the traditional decision theory.

The book combines new research results with practical applications. It draws on the rich research body of behavioral finance and on profound experience in the practice of wealth management. The book starts with the behavioral biases—the mistakes that people make when dealing with information and making financial decisions. The chapter describes the biases, discusses their implications for financial decisions, and suggests strategies with a proven success in moderating the biases. The following four chapters discuss the cultural dimensions of the biases and their biological foundation as well as their moderation and suggest how advisors could proceed in assessing the biases of their clients.

Thereafter, we explain decision theory (rational and behavioral) as a foundation of finance and show how it can be used in the construction of clients' portfolios and for the design of structured products. The question of how optimal portfolios should be adjusted over time is discussed in the following two chapters. The last chapters show how the new insights that behavioral finance has generated can be applied to client advisory, to designing behaviorally founded risk profiles, and to structuring the wealth management process. Thus, our books give a scientific foundation to financial advice given in private banking, which in practice is seen more as an art than a science. We believe that practitioners find some useful foundation for their work and that the transition from the art of advice to the science of advice is not disruptive but smooth.

This book is the second edition of the book Behavioral Finance for Private Banking that was published in the middle of the financial crisis. Many banks and financial advisors used the existing body of knowledge to improve their products and advisory services. A tool that we have developed demonstrates how this can be done.2 In addition, this book benefits from insights of new areas of research such as cultural finance, neurofinance, and fintech. Finally, it compares the insights behavioral finance has gained with the new regulatory requirements in Europe (MiFID II) and in Switzerland (FIDLEG).

We are grateful to Mei Wang and Marc Oliver Rieger for their collaboration in the assessment of the cultural dimensions of investors' behavior. Moreover, this work greatly benefited from BhFS Behavioral Finance Solutions, a spinoff firm of the University of Zurich and the University of St. Gallen, which allowed us to present their tools. Last but not least we are grateful to the Wiley team and to Marie Hardelauf for their patience and help in editing our book.