eBook - ePub

Private Equity Firms

Their Role in the Formation of Strategic Alliances

Kirsten Burkhardt

This is a test

- English

- ePUB (mobile friendly)

- Available on iOS & Android

eBook - ePub

Private Equity Firms

Their Role in the Formation of Strategic Alliances

Kirsten Burkhardt

Book details

Book preview

Table of contents

Citations

About This Book

This work analyzes the role of private equity firms (SCIs) in forming strategic alliances in the French private equity market. The subject is important because the formation of alliances and, more generally, the networking of SMEs, could be an alternative to the lack of medium-sized companies in France. For French SCIs, which are increasingly in a competitive situation, assistance in forming alliances for their holdings may represent a new activity and be a source of competitive advantage. The work is positioned transversally, touching the areas of corporate governance, entrepreneurial finance and strategy.

Frequently asked questions

At the moment all of our mobile-responsive ePub books are available to download via the app. Most of our PDFs are also available to download and we're working on making the final remaining ones downloadable now. Learn more here.

Both plans give you full access to the library and all of Perlego’s features. The only differences are the price and subscription period: With the annual plan you’ll save around 30% compared to 12 months on the monthly plan.

We are an online textbook subscription service, where you can get access to an entire online library for less than the price of a single book per month. With over 1 million books across 1000+ topics, we’ve got you covered! Learn more here.

Look out for the read-aloud symbol on your next book to see if you can listen to it. The read-aloud tool reads text aloud for you, highlighting the text as it is being read. You can pause it, speed it up and slow it down. Learn more here.

Yes, you can access Private Equity Firms by Kirsten Burkhardt in PDF and/or ePUB format, as well as other popular books in Mathematics & Applied Mathematics. We have over one million books available in our catalogue for you to explore.

Information

1

Concepts Underlying the Role of Private Equity Firms in Forming Alliances

In this chapter, we explain the notions and concepts that are required to understand our problem. We begin by introducing the concept of private equity (PE) in section 1.1. In section 1.2, we consider the concept of a strategic alliance, as used in this book. In section 1.3, we present French private equity firms (PEFs) more specifically and the formation of strategic alliances.

1.1. Private equity

Let us begin with an introduction to the main characteristics of PE (section 1.1.1), followed by a presentation of the features that are specific to the French market (section 1.1.2).

1.1.1. Main characteristics

PEFs are vehicles that enable individuals or institutions to operate in the PE market [PEN 07, p. 2]. These vehicles often invest large amounts in equity, typically in small-or medium-sized unlisted companies. They often occur in several stages and over several years [DES 01a, DES 01b, PEN 07].

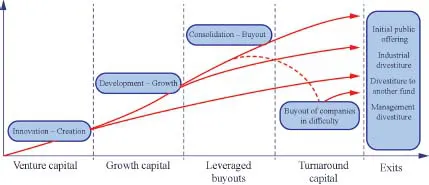

Depending on the lifecycle phase in which PEFs are involved in SME financing (Figure 1.1), one can distinguish between:

- – venture capital associated with the start-up of innovative companies with high potential;

- – growth capital and leveraged buy-outs (LBOs), which finance the transfer or acquisition of unlisted companies;

- – turnaround capital, which concerns firms that are experiencing temporary difficulties [BAN 07, p. 115];

- – more recently, intervention in companies wishing to unlist [GLA 08, p. 7].

Venture capital and turnaround capital operations are risky transactions and are characterized by an equity contribution. Growth capital and buy-out capital operations, which occur during the lifecycle of a company, involve a combined contribution of equity and debt (leverage effect) [BAN 07, p. 115]. LBO is defined as when a company is bought out by equity investors associated with the company’s management. The transaction is financed by equity capital as well as by a significant portion of debt that will have to be repaid in the years after the acquisition of the company. The source of repayments is cash flows that are generated either by the company’s operating cycle or through the sale of assets. Several LBO variants are possible.

Management buy-out (MBO) is the term used to describe a LBO transaction in which the management team that is already in place buys the company, with all or some of its employees and equity investors. When a company is acquired by an external management team and equity investors, the transaction is called a management buy-in. A combination of the last two variants is also possible and is known as BIMBO, a buy-in management buyout. An owner buy-out is defined as when a company is acquired by the owner-manager of that company in combination with equity investors. Finally, leveraged build-up is also possible. This is when an equity investor takes over several companies to form a larger entity from them. In general, these companies would be from the same sector. The build-up transaction is then referred to as “sector consolidation”. Buy-outs are also financed by a combination of equity and debt, usually with a very large debt component.

The above definition includes several particularities that characterize the field of PE. To highlight these, let us turn to Desbrières’ study [DES 01a, DES 01b].

Intervention in unlisted companies: The most distinctive feature is intervention in unlisted companies. First, these companies are not subject to the same disclosure requirements as listed companies. As a result, they tend to be less transparent.

In addition, information that is disclosed is generally not standardized or certified, making it more difficult to assess. There tends to be a more pronounced information asymmetry between these companies and their investors [NOO 99]. Second, as unlisted companies, their shareholding is often thinly spread. The liquidity of securities is therefore lower than that of listed companies. As a result, the PE market is inefficient and the transfer of securities takes place over the counter.

Figure 1.1. Private equity and business lifecycle (source: France Invest). For a color version of this figure, see www.iste.co.uk/burkhardt/equity.zip

Large amounts invested: The amounts invested by PEFs are often large, which limits the number of companies that can be financed and therefore the means of diversification.

Greater uncertainty regarding the profitability of investments: The profitability of investments undertaken by PEFs is more uncertain, in particular because of the nature of the activities of companies in which the PEFs intervene. They often operate in innovative sectors such as high technology. This uncertainty increases if PEFs intervene in companies that are in particularly vulnerable phases.

Information asymmetry, the lack of historic information (depending on the phase of the companies being financed), and uncertainty about future cash flows, all make standard valuation methods difficult to apply (such as NPV), which makes the valuation of companies to be financed more costly. In order to reduce the information asymmetry, the selection of projects to be financed is done through careful analysis because of diligence and the implementation of an often active and interventionist monitoring/control level in company management. As this is more in-depth and more expensive than with standardized and certified information, the number of files that can be examined by a PEF is limited. This inevitable focus on certain companies limits the diversification possibilities of the PEF portfolio. In return for such risk taking, PEFs generally hold significant control blocks and sit on the board of directors of the selected companies [SAH 90]. As a result, PEFs are able to constrain the discretionary space of managers and influence the nature of the strategy being purs...

Table of contents

- Cover

- Table of Contents

- Preface

- Introduction

- 1 Concepts Underlying the Role of Private Equity Firms in Forming Alliances

- 2 The Role of Private Equity Firms in Alliance Formation from the Perspective of Value Creation

- 3 Empirical Analysis with Explanatory Design of the Role of French Private Equity Firms in the Formation of Alliances

- Conclusion

- Bibliography

- Index

- End User License Agreement