- English

- ePUB (mobile friendly)

- Available on iOS & Android

The Volatility Smile

About this book

The Volatility Smile

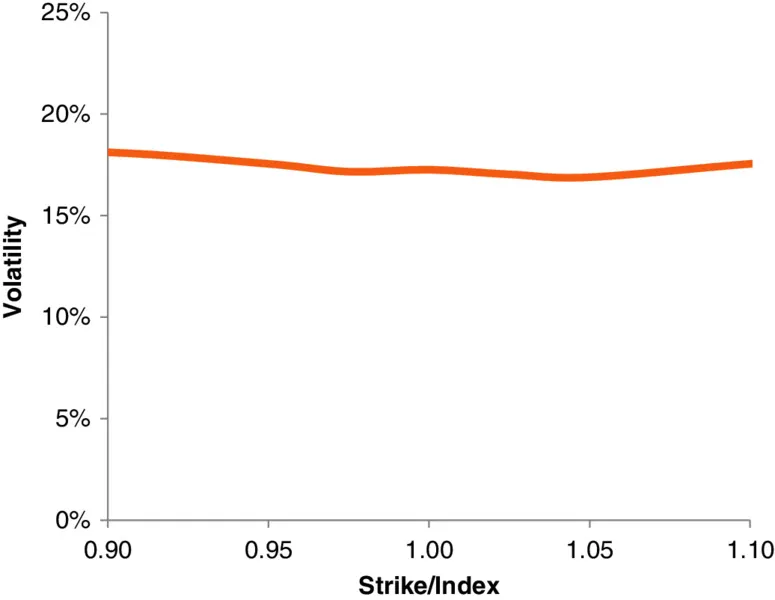

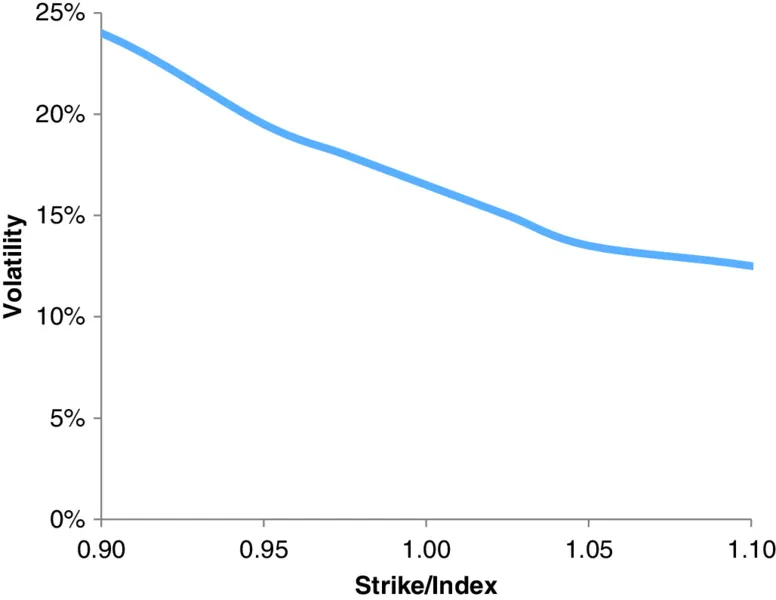

The Black-Scholes-Merton option model was the greatest innovation of 20th century finance, and remains the most widely applied theory in all of finance. Despite this success, the model is fundamentally at odds with the observed behavior of option markets: a graph of implied volatilities against strike will typically display a curve or skew, which practitioners refer to as the smile, and which the model cannot explain. Option valuation is not a solved problem, and the past forty years have witnessed an abundance of new models that try to reconcile theory with markets.

The Volatility Smile presents a unified treatment of the Black-Scholes-Merton model and the more advanced models that have replaced it. It is also a book about the principles of financial valuation and how to apply them. Celebrated author and quant EmanuelDerman and Michael B. Miller explain not just the mathematics but the ideas behind the models. By examining the foundations, the implementation, and the pros and cons of various models, and by carefully exploring their derivations and their assumptions, readers will learn not only how to handle the volatility smile but how to evaluate and build their own financial models.

Topics covered include:

- The principles of valuation

- Static and dynamic replication

- The Black-Scholes-Merton model

- Hedging strategies

- Transaction costs

- The behavior of the volatility smile

- Implied distributions

- Local volatility models

- Stochastic volatility models

- Jump-diffusion models

The first half of the book, Chapters 1 through 13, can serve as a standalone textbook for a course on option valuation and the Black-Scholes-Merton model, presenting the principles of financial modeling, several derivations of the model, and a detailed discussion of how it is used in practice. The second half focuses on the behavior of the volatility smile, and, in conjunction with the first half, can be used for as the basis for a more advanced course.

Tools to learn more effectively

Saving Books

Keyword Search

Annotating Text

Listen to it instead

Information

Chapter 1

Overview

- Financial models in light of the great financial crisis.

- The difficulties of option valuation.

- An introduction to the volatility smile.

- Financial science and financial engineering.

- The purpose and use of models.

Introduction

A year or so ago, my daughter had seen . . . some disparaging remarks I had made about financial engineering. She sent it to my grandson, who normally didn't communicate with me very much. He sent me an email, “Grandpa, don't blame it on us! We were just following the orders we were getting from our bosses.” The only thing I could do was send him back an email, “I will not accept the Nuremberg excuse.”

The Black-Scholes-Merton Model and Its Discontents

A Quick Look at the Implied Volatility Smile

No-Nonsense Financial Modeling

I am not interested in proofs, but only in what nature does.—Paul Dirac

About Theorems and Laws

Table of contents

- Cover

- Series

- Title Page

- Copyright

- Dedication

- Preface

- Acknowledgments

- About the Authors

- Chapter 1: Overview

- Chapter 2: The Principle of Replication

- Chapter 3: Static and Dynamic Replication

- Chapter 4: Variance Swaps: A Lesson in Replication

- Chapter 5: The P&L of Hedged Option Strategies in a Black-Scholes-Merton World

- Chapter 6: The Effect of Discrete Hedging on P&L

- Chapter 7: The Effect of Transaction Costs on P&L

- Chapter 8: The Smile: Stylized Facts and Their Interpretation

- Chapter 9: No-Arbitrage Bounds on the Smile

- Chapter 10: A Survey of Smile Models

- Chapter 11: Implied Distributions and Static Replication

- Chapter 12: Weak Static Replication

- Chapter 13: The Binomial Model and Its Extensions

- Chapter 14: Local Volatility Models

- Chapter 15: Consequences of Local Volatility Models

- Chapter 16: Local Volatility Models: Hedge Ratios and Exotic Option Values

- Chapter 17: Some Final Remarks on Local Volatility Models

- Chapter 18: Patterns of Volatility Change

- Chapter 19: Introducing Stochastic Volatility Models

- Chapter 20: Approximate Solutions to Some Stochastic Volatility Models

- Chapter 21: Stochastic Volatility Models: The Smile for Zero Correlation

- Chapter 22: Stochastic Volatility Models: The Smile with Mean Reversion and Correlation

- Chapter 23: Jump-Diffusion Models of the Smile: Introduction

- Chapter 24: The Full Jump-Diffusion Model

- Epilogue

- Appendix A: Some Useful Derivatives of the Black-Scholes-Merton Model

- Appendix B: Backward Itô Integrals

- Appendix C: Variance Swap Piecewise-Linear Replication

- Answers to End-of-Chapter Problems

- References

- Index

- EULA

Frequently asked questions

- Essential is ideal for learners and professionals who enjoy exploring a wide range of subjects. Access the Essential Library with 800,000+ trusted titles and best-sellers across business, personal growth, and the humanities. Includes unlimited reading time and Standard Read Aloud voice.

- Complete: Perfect for advanced learners and researchers needing full, unrestricted access. Unlock 1.4M+ books across hundreds of subjects, including academic and specialized titles. The Complete Plan also includes advanced features like Premium Read Aloud and Research Assistant.

Please note we cannot support devices running on iOS 13 and Android 7 or earlier. Learn more about using the app