Energy Trading and Risk Management

A Practical Approach to Hedging, Trading and Portfolio Diversification

- English

- ePUB (mobile friendly)

- Available on iOS & Android

Energy Trading and Risk Management

A Practical Approach to Hedging, Trading and Portfolio Diversification

About This Book

A comprehensive overview of trading and risk management in the energy markets

Energy Trading and Risk Management provides a comprehensive overview of global energy markets from one of the foremost authorities on energy derivatives and quantitative finance. With an approachable writing style, Iris Mack breaks down the three primary applications for energy derivatives markets – Risk Management, Speculation, and Investment Portfolio Diversification – in a way that hedge fund traders, consultants, and energy market participants can apply in their day to day trading activities.

- Moving from the fundamentals of energy markets through simple and complex derivatives trading, hedging strategies, and industry-specific case studies, Dr. Mack walks readers through energy trading and risk management concepts at an instructive pace, supporting her explanations with real-world examples, illustrations, charts, and precise definitions of important and often-misunderstood terms.

- From stochastic pricing models for exotic derivatives, to modern portfolio theory (MPT), energy portfolio management (EPM), to case studies dealing specifically with risk management challenges unique to wind and hydro-electric power, the bookguides readers through the complex world of energy trading and risk management to help investors, executives, and energy professionals ensure profitability and optimal risk mitigation in every market climate.

Energy Trading and Risk Management is a great resource to help grapple with the very interesting but oftentimes complex issues that arise in energy trading and risk management.

Frequently asked questions

CHAPTER 1

Energy Markets Fundamentals

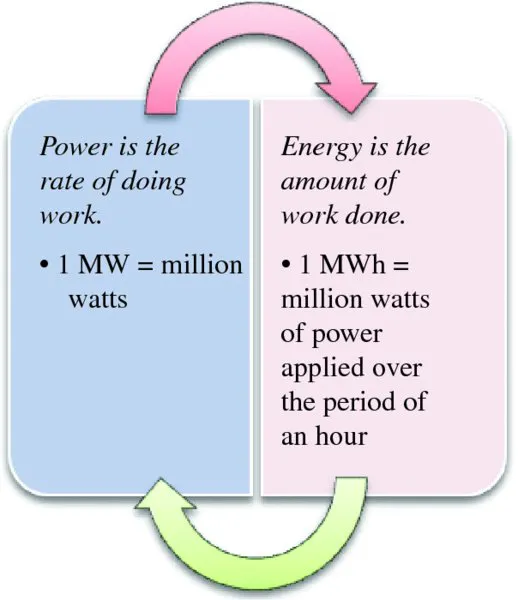

- Power is the metered net electrical transfer rate at any given moment. It is measured in megawatts (MW). A watt is equal to one joule per second. The joule is a derived unit of energy, work, or amount of heat in the International System of Units.

- Energy is electricity that flows through a metered point for a given period and is measured in megawatt-hours.

- Electric power is the rate at which electric energy is transferred by an electric circuit. The instantaneous electrical power P delivered to a component is given by

- V(t) is the potential difference (or voltage drop) across the component (measured in volts)

- I(t) is the current (measured in amperes)

- MWh (megawatt-hour) is a unit of energy

- MW (megawatt) is a unit of power

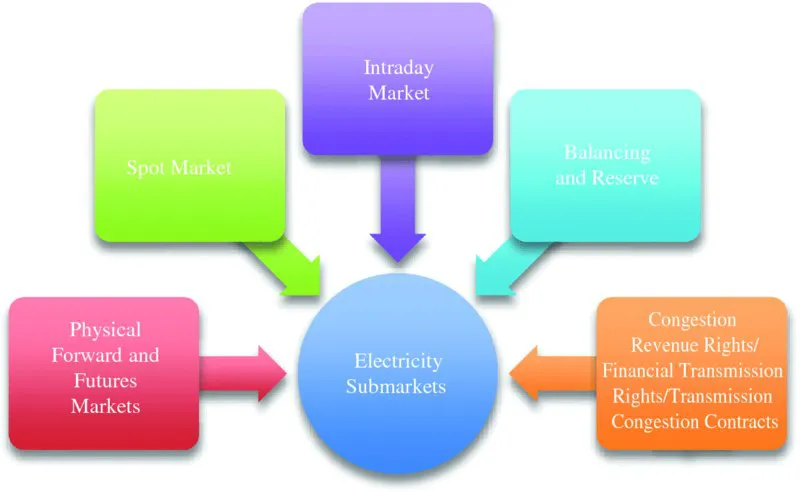

- Physical forward and futures markets

- Spot market

- Intra-Day market

- Balancing and reserve

- Congestion revenue rights (CRRs), financial transmission rights (FTRs), and transmission congestion contracts (TCCs)

1.1 PHYSICAL FORWARD AND FUTURES MARKETS

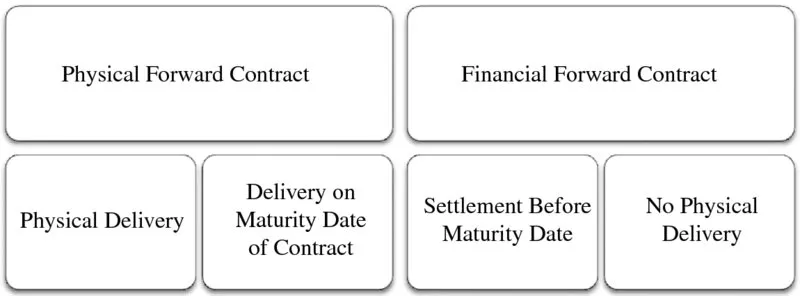

- If a forward contract is settled before its maturity date, it is a financial forward contract since no electric power is physically delivered.

- A forward contract is a physical contract if the electric power is delivered physically.

Table of contents

- Cover

- Series

- Titlepage

- Copyright

- Dedication

- Preface

- Acknowledgements

- About the Author

- About the Contributors

- Chapter 1: Energy Markets Fundamentals

- Chapter 2: Quant Models in the Energy Markets: Role and Limitations

- Chapter 3: Plain Vanilla Energy Derivatives

- Chapter 4: Exotic Energy Derivatives

- Chapter 5: Risk Management and Hedging Strategies

- Chapter 6: Illustrations of Hedging with Energy Derivatives

- Chapter 7: Speculation

- Chapter 8: Energy Portfolios

- Chapter 9: Hedging Nonlinear Payoffs Using Options: The Case of a New Subsidies Regime for Renewables

- Chapter 10: Case Study: Hydro Power Generation and Behavioral Finance in the U.S. Pacific Northwest

- Bibliography

- Index

- Wiley End User License Agreement