eBook - ePub

Money, Capital Formation and Economic Growth

International Comparison with Time Series Analysis

Masanori Amano

This is a test

- English

- ePUB (apto para móviles)

- Disponible en iOS y Android

eBook - ePub

Money, Capital Formation and Economic Growth

International Comparison with Time Series Analysis

Masanori Amano

Detalles del libro

Vista previa del libro

Índice

Citas

Información del libro

This book proposes new methods of detecting causality among several dynamic variables and of estimating divisions of nominal income changes into changes in output and prices. Amano builds on established traditions of macro-dynamics and the theories of Keynes and Freidman, while providing innovative perspectives and important policy implications.

Preguntas frecuentes

¿Cómo cancelo mi suscripción?

¿Cómo descargo los libros?

Por el momento, todos nuestros libros ePub adaptables a dispositivos móviles se pueden descargar a través de la aplicación. La mayor parte de nuestros PDF también se puede descargar y ya estamos trabajando para que el resto también sea descargable. Obtén más información aquí.

¿En qué se diferencian los planes de precios?

Ambos planes te permiten acceder por completo a la biblioteca y a todas las funciones de Perlego. Las únicas diferencias son el precio y el período de suscripción: con el plan anual ahorrarás en torno a un 30 % en comparación con 12 meses de un plan mensual.

¿Qué es Perlego?

Somos un servicio de suscripción de libros de texto en línea que te permite acceder a toda una biblioteca en línea por menos de lo que cuesta un libro al mes. Con más de un millón de libros sobre más de 1000 categorías, ¡tenemos todo lo que necesitas! Obtén más información aquí.

¿Perlego ofrece la función de texto a voz?

Busca el símbolo de lectura en voz alta en tu próximo libro para ver si puedes escucharlo. La herramienta de lectura en voz alta lee el texto en voz alta por ti, resaltando el texto a medida que se lee. Puedes pausarla, acelerarla y ralentizarla. Obtén más información aquí.

¿Es Money, Capital Formation and Economic Growth un PDF/ePUB en línea?

Sí, puedes acceder a Money, Capital Formation and Economic Growth de Masanori Amano en formato PDF o ePUB, así como a otros libros populares de Economics y Econometrics. Tenemos más de un millón de libros disponibles en nuestro catálogo para que explores.

Información

Categoría

EconomicsCategoría

Econometrics1

The ‘Missing Equations’ for Postwar USA, UK, and Japan

1.1 Introduction

Searching for factors which determine the proportion of output change in nominal income change, and the proportion of price change in nominal income change, has been regarded as one of the unresolved questions in macro-economics. (See Nobay and Johnson 1977; Gordon 2009, ch 7.) In the papers which were intended to describe monetary theory in the monetarist tradition, M. Friedman (1970, 1971) and Gordon (1974) presented frameworks for monetary analysis which describe the quantity theory and the income-expenditure theory. The two frameworks differ in the last equation, which solves the variables of the systems determinately. The difference between the two frameworks described by Friedman was that one made output (national income) fixed for quantity theory, while the other made the price level fixed for income-expenditure theory.

In his 1971 paper, Friedman also showed a model in which nominal income is an endogenous variable, but the division of nominal income into output and the price level was left unspecified. Originally, Friedman called the last (seventh) equation to close both systems ‘the missing equation’. However, in this chapter I would like to define the missing equation as that which describes the proportions of output change and price change in nominal income change because Friedman noted in Gordon (1974) that none of his models (that is, those mentioned above) ‘have anything to say about the factors that determine the proportions inwhich achange innominal income will,in the short-run, be divided between price change and output change’. (Gordon (1974, p.45)).

In spite of the possible importance of the concept, the theoretical or empirical works dealing with the missing equation have not so far been large in number. The early literature of Laidler (1973) and McCallum (1973) correctly recognized the need for empirical implementation of Friedman’s analytical proposal, but both authors seem to have limited the number of determinants (independent variables) of the missing equation.

In this chapter we attempt to derive an equation describing the proportion of annual output change in nominal income change (in other words, nominal income elasticity of total output), based on an optimizing behavior of the firm sector, where the equation is a function of short-term aggregate demand components (including money supply), labor market tightness, technical progress, and price expectations. Then we estimate the equation using the two-stage least squares method with forward-looking rational expectations regarding inflation for three countries, the USA, the UK, and Japan, for the postwar period, and also make some comparisons between those countries.

The following empirical work will reveal some interesting contrasts between the three countries regarding short-run output responses to changes in aggregate demand and supply components, inflation expectations and so on.

The next section (Section 2) sets out firms’ optimizing behavior and, combining with it an equation describing short-term economic growth of the economy, derives the missing equation (nominal income elasticity of output) as a function of the variables mentioned above. Section 3 estimates the equation for the period 1951 through 1998 using annual data of the three countries (see Section 3 for the reasons behind this period choice), and then compares the empirical results. Finally, Section 4 presents a summary and concluding remarks.

1.2 Firm Behavior and Nominal Income Elasticity of Output

We start with some definitions of variables and concepts. Let us write nominal income (nominal GDP) in some year as Y. Then, writing P for the price level (GDP deflator) and Q for real output (real GDP) of the same year, one obviously has Y = P ·Q. Also, let gz be the annual growth rate of z (z = Y, P, or Q); the descriptions of variables to appear are gathered after Section 4. Then, from Y = P · Q,

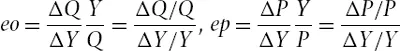

Next, define eo as the elasticity of output regarding nominal income, and ep as the elasticity of the price level regarding nominal income. Then one obtains

where Δ is a difference operator. If one regards ΔYt as Yt — Yt-1, where the subscript t refers to some year, then eo and ep can be written as

Evidently, one has eo + ep = 1. Hence the rest of this chapter will focus on the determinants of gP and gQ, to investigate finally on what variables eo in each year depends. Annual changes in eo for the USA, the UK, and Japan are shown in Figure 1.1.

Figure 1.1 Elasticity of real outputs of the three countries

1.2.1 The Determinants of the Inflation Rate

We will now consider the determinants of growth in the price level gP and those of the output growth gQ. In a manner similar to Calvo (1983), Rotemberg (1996), and Gali and Gertler (1999), we consider a firm’s quadratic cost function, Ct = C(s > t), of the following form, where t means the current year. The firm minimizes the cost function with respect to the price p in logarithm (that is, pt = lnPt) that it charges for its product facing a monopolistically competitive market.1

...

Índice

- Cover

- Title Page

- Copyright Page

- Contents

- List of Figures

- List of Tables

- Preface and Acknowledgments

- Abstracts

- PART I

- PART II

- PART III

- PART IV

- Names Index

- Subject Index

Estilos de citas para Money, Capital Formation and Economic Growth

APA 6 Citation

Amano, M. (2012). Money, Capital Formation and Economic Growth ([edition unavailable]). Palgrave Macmillan UK. Retrieved from https://www.perlego.com/book/3485133/money-capital-formation-and-economic-growth-international-comparison-with-time-series-analysis-pdf (Original work published 2012)

Chicago Citation

Amano, Masanori. (2012) 2012. Money, Capital Formation and Economic Growth. [Edition unavailable]. Palgrave Macmillan UK. https://www.perlego.com/book/3485133/money-capital-formation-and-economic-growth-international-comparison-with-time-series-analysis-pdf.

Harvard Citation

Amano, M. (2012) Money, Capital Formation and Economic Growth. [edition unavailable]. Palgrave Macmillan UK. Available at: https://www.perlego.com/book/3485133/money-capital-formation-and-economic-growth-international-comparison-with-time-series-analysis-pdf (Accessed: 15 October 2022).

MLA 7 Citation

Amano, Masanori. Money, Capital Formation and Economic Growth. [edition unavailable]. Palgrave Macmillan UK, 2012. Web. 15 Oct. 2022.