eBook - ePub

Money, Capital Formation and Economic Growth

International Comparison with Time Series Analysis

Masanori Amano

This is a test

- English

- ePUB (adapté aux mobiles)

- Disponible sur iOS et Android

eBook - ePub

Money, Capital Formation and Economic Growth

International Comparison with Time Series Analysis

Masanori Amano

Détails du livre

Aperçu du livre

Table des matières

Citations

À propos de ce livre

This book proposes new methods of detecting causality among several dynamic variables and of estimating divisions of nominal income changes into changes in output and prices. Amano builds on established traditions of macro-dynamics and the theories of Keynes and Freidman, while providing innovative perspectives and important policy implications.

Foire aux questions

Comment puis-je résilier mon abonnement ?

Il vous suffit de vous rendre dans la section compte dans paramètres et de cliquer sur « Résilier l’abonnement ». C’est aussi simple que cela ! Une fois que vous aurez résilié votre abonnement, il restera actif pour le reste de la période pour laquelle vous avez payé. Découvrez-en plus ici.

Puis-je / comment puis-je télécharger des livres ?

Pour le moment, tous nos livres en format ePub adaptés aux mobiles peuvent être téléchargés via l’application. La plupart de nos PDF sont également disponibles en téléchargement et les autres seront téléchargeables très prochainement. Découvrez-en plus ici.

Quelle est la différence entre les formules tarifaires ?

Les deux abonnements vous donnent un accès complet à la bibliothèque et à toutes les fonctionnalités de Perlego. Les seules différences sont les tarifs ainsi que la période d’abonnement : avec l’abonnement annuel, vous économiserez environ 30 % par rapport à 12 mois d’abonnement mensuel.

Qu’est-ce que Perlego ?

Nous sommes un service d’abonnement à des ouvrages universitaires en ligne, où vous pouvez accéder à toute une bibliothèque pour un prix inférieur à celui d’un seul livre par mois. Avec plus d’un million de livres sur plus de 1 000 sujets, nous avons ce qu’il vous faut ! Découvrez-en plus ici.

Prenez-vous en charge la synthèse vocale ?

Recherchez le symbole Écouter sur votre prochain livre pour voir si vous pouvez l’écouter. L’outil Écouter lit le texte à haute voix pour vous, en surlignant le passage qui est en cours de lecture. Vous pouvez le mettre sur pause, l’accélérer ou le ralentir. Découvrez-en plus ici.

Est-ce que Money, Capital Formation and Economic Growth est un PDF/ePUB en ligne ?

Oui, vous pouvez accéder à Money, Capital Formation and Economic Growth par Masanori Amano en format PDF et/ou ePUB ainsi qu’à d’autres livres populaires dans Economics et Econometrics. Nous disposons de plus d’un million d’ouvrages à découvrir dans notre catalogue.

Informations

Sujet

EconomicsSous-sujet

Econometrics1

The ‘Missing Equations’ for Postwar USA, UK, and Japan

1.1 Introduction

Searching for factors which determine the proportion of output change in nominal income change, and the proportion of price change in nominal income change, has been regarded as one of the unresolved questions in macro-economics. (See Nobay and Johnson 1977; Gordon 2009, ch 7.) In the papers which were intended to describe monetary theory in the monetarist tradition, M. Friedman (1970, 1971) and Gordon (1974) presented frameworks for monetary analysis which describe the quantity theory and the income-expenditure theory. The two frameworks differ in the last equation, which solves the variables of the systems determinately. The difference between the two frameworks described by Friedman was that one made output (national income) fixed for quantity theory, while the other made the price level fixed for income-expenditure theory.

In his 1971 paper, Friedman also showed a model in which nominal income is an endogenous variable, but the division of nominal income into output and the price level was left unspecified. Originally, Friedman called the last (seventh) equation to close both systems ‘the missing equation’. However, in this chapter I would like to define the missing equation as that which describes the proportions of output change and price change in nominal income change because Friedman noted in Gordon (1974) that none of his models (that is, those mentioned above) ‘have anything to say about the factors that determine the proportions inwhich achange innominal income will,in the short-run, be divided between price change and output change’. (Gordon (1974, p.45)).

In spite of the possible importance of the concept, the theoretical or empirical works dealing with the missing equation have not so far been large in number. The early literature of Laidler (1973) and McCallum (1973) correctly recognized the need for empirical implementation of Friedman’s analytical proposal, but both authors seem to have limited the number of determinants (independent variables) of the missing equation.

In this chapter we attempt to derive an equation describing the proportion of annual output change in nominal income change (in other words, nominal income elasticity of total output), based on an optimizing behavior of the firm sector, where the equation is a function of short-term aggregate demand components (including money supply), labor market tightness, technical progress, and price expectations. Then we estimate the equation using the two-stage least squares method with forward-looking rational expectations regarding inflation for three countries, the USA, the UK, and Japan, for the postwar period, and also make some comparisons between those countries.

The following empirical work will reveal some interesting contrasts between the three countries regarding short-run output responses to changes in aggregate demand and supply components, inflation expectations and so on.

The next section (Section 2) sets out firms’ optimizing behavior and, combining with it an equation describing short-term economic growth of the economy, derives the missing equation (nominal income elasticity of output) as a function of the variables mentioned above. Section 3 estimates the equation for the period 1951 through 1998 using annual data of the three countries (see Section 3 for the reasons behind this period choice), and then compares the empirical results. Finally, Section 4 presents a summary and concluding remarks.

1.2 Firm Behavior and Nominal Income Elasticity of Output

We start with some definitions of variables and concepts. Let us write nominal income (nominal GDP) in some year as Y. Then, writing P for the price level (GDP deflator) and Q for real output (real GDP) of the same year, one obviously has Y = P ·Q. Also, let gz be the annual growth rate of z (z = Y, P, or Q); the descriptions of variables to appear are gathered after Section 4. Then, from Y = P · Q,

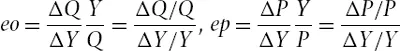

Next, define eo as the elasticity of output regarding nominal income, and ep as the elasticity of the price level regarding nominal income. Then one obtains

where Δ is a difference operator. If one regards ΔYt as Yt — Yt-1, where the subscript t refers to some year, then eo and ep can be written as

Evidently, one has eo + ep = 1. Hence the rest of this chapter will focus on the determinants of gP and gQ, to investigate finally on what variables eo in each year depends. Annual changes in eo for the USA, the UK, and Japan are shown in Figure 1.1.

Figure 1.1 Elasticity of real outputs of the three countries

1.2.1 The Determinants of the Inflation Rate

We will now consider the determinants of growth in the price level gP and those of the output growth gQ. In a manner similar to Calvo (1983), Rotemberg (1996), and Gali and Gertler (1999), we consider a firm’s quadratic cost function, Ct = C(s > t), of the following form, where t means the current year. The firm minimizes the cost function with respect to the price p in logarithm (that is, pt = lnPt) that it charges for its product facing a monopolistically competitive market.1

...

Table des matières

- Cover

- Title Page

- Copyright Page

- Contents

- List of Figures

- List of Tables

- Preface and Acknowledgments

- Abstracts

- PART I

- PART II

- PART III

- PART IV

- Names Index

- Subject Index

Normes de citation pour Money, Capital Formation and Economic Growth

APA 6 Citation

Amano, M. (2012). Money, Capital Formation and Economic Growth ([edition unavailable]). Palgrave Macmillan UK. Retrieved from https://www.perlego.com/book/3485133/money-capital-formation-and-economic-growth-international-comparison-with-time-series-analysis-pdf (Original work published 2012)

Chicago Citation

Amano, Masanori. (2012) 2012. Money, Capital Formation and Economic Growth. [Edition unavailable]. Palgrave Macmillan UK. https://www.perlego.com/book/3485133/money-capital-formation-and-economic-growth-international-comparison-with-time-series-analysis-pdf.

Harvard Citation

Amano, M. (2012) Money, Capital Formation and Economic Growth. [edition unavailable]. Palgrave Macmillan UK. Available at: https://www.perlego.com/book/3485133/money-capital-formation-and-economic-growth-international-comparison-with-time-series-analysis-pdf (Accessed: 15 October 2022).

MLA 7 Citation

Amano, Masanori. Money, Capital Formation and Economic Growth. [edition unavailable]. Palgrave Macmillan UK, 2012. Web. 15 Oct. 2022.